This issue of the Financial Management Office Newsletter includes information about the following:

- Administrative Procedure Feedback on Proposed Updates

- Reminder Revised AP 8.851 Employee Out of State and Intra State Travel Effective 8/15/23

- Creating New General Fund Related NI Accounts

- Equipment – FY 2023 Annual Inventory Verification Report

- Payment Request (PREQ) Reminders

- Disbursement Voucher (DV) Reminders

- New e-mail Notification for Changes Made to Employees’ Direct Deposit Accounts

- Payments as stipends, travel reimbursements, scholarships and tax facts

- Resources

The Financial Management Office Newsletter is distributed monthly. Should you have any questions about this newsletter, contact Amy Kunz via email: amykunz@hawaii.edu.

Subscribe to this FMO Newsletter

Unsubscribe from this FMO Newsletter

___________________________________________________________________________________________________________________

Administrative Procedure Feedback on Proposed Updates

Target Audience: Fiscal Administrators and Fiscal Support Staff

In an effort to ensure the policies that help guide our work are updated, FMO has reviewed several Administrative Procedures and we are looking for your feedback on the proposed updates. In this article we have included a link to the current policy as well as a link that will temporarily offer the red-lined version of the proposed updates. We have also provided the contact to provide the feedback for each AP. Please review and provide any feedback by August 25. The red-lined versions will be deactivated at that time and feedback will be reviewed and incorporated where appropriate.

- AP 8.651 – Non-Student Accounts Receivable and Delinquent Financial Obligations

Proposed policy updates (click for draft):

Revisions to the policy include (1) Removes requirement for the Director of General Accounting’s approval of Departmental Accounts Receivable Systems and related form, formerly Attachment #2; (2) Moves Department Head and Fiscal Administrator responsibilities previously included in Attachment #2 to Section III.A.3.a; (3) Changes contact for collection agency referrals from the Director of General Accounting to the Office of Procurement Management.

Contact with feedback: Suzanne Efhan (efhans@hawaii.edu) - AP 8.620 – Gifts

Proposed policy updates (click for draft):

Updates to reflect University of Hawai’i Foundation (Foundation) Policies and Procedures (FDS-DP-13) for gifts with titles (i.e., vehicles, airplanes, real estate) last dated November 3, 2022. Revisions to the policy include (1) Delineation of Foundation; donor; and University responsible person, Capital Asset Accounting Office, and Tax Office responsibilities for gifts, Gifts-in-Kind (GIK), and gifts with titles; (2) Addition of Form GA-01 Transmittal of Gift of Qualified Vehicle (Car, Boat, Airplane, Value Over $500).

Contact with feedback: Suzanne Efhan (efhans@hawaii.edu) - AP 8.565 – Tax Reporting of Payments to Postdoctoral Appointments (NEW)

Proposed new policy (click for draft):

Proposals in the policy include (1) New procedures for tax reporting of payment to various types of postdoctoral appointments at University of Hawai’i, pursuant to Executive Policy EP 12.227, Postdoctoral Appointments. (2) Definitions of 3 types of Postdoctoral Appointments; (3) Departments responsible for certain guidance or assistance for these postdoctoral appointments (4) Grid summarizing tax effects for these postdoctoral appointments.

Contact with feedback: Kenneth Lum (kenlum@hawaii.edu)

We appreciate your review and feedback. If you have issues or concerns with any other FMO APs, please let us know so we can add them to our review cycle.

___________________________________________________________________________________________________________________

Reminder Revised AP 8.851 Employee Out of State and Intra State Travel Effective 8/15/23

Target Audience: Fiscal Administrators and Fiscal Support Staff

As a reminder, the revised AP 8.851 will go into effect August 15, 2023. Under this revised AP, travelers will be eligible for a travel advance under the following conditions:

- Set up to receive advances via ePayment.

- To individuals with no other outstanding travel completions associated with an advance more than 30 days after the return date from their previous trip(s).

- For Lodging up to the Federal Allowable Rate (FAR) or the quoted cost, whichever is lesser.

- For M&IE up to the Federal Allowable Rate (FAR).

- For airfare and conference fees with receipt.

- For unconventional travel expenses.

Disbursing will accept requests for travel advances through September 15, 2023 for out-of-pocket expenses incurred prior to August 15, 2023. The FAQs for eTravel have been updated to reflect the new travel advance policy.

An email reminder detailing the changes to travel advances was sent to all travelers who received an advance between FY 2022 and FY 2023.

If there are any questions regarding these changes, please email etravel-help@lists.hawaii.edu.

___________________________________________________________________________________________________________________

Creating New General Fund Related NI Accounts

Target Audience: Fiscal Administrators and Fiscal Support Staff

To expedite establishment and utilization of new General Fund accounts, General Accounting (GA) will no longer require the FA’s approval for the establishment of the related Non-Imposed fringe (NI) accounts. The new workflow will be as follows:

- FA submits KFS eDoc to create a new General Fund account.

- GA reviews, assigns account number, and approves.

- GA creates and approves the related NI account; e-doc will be routed to the FA to acknowledge.

- GA initiates and edits the new General Fund account’s attributes: Non-Imposed Fringe Indicator (Y), Fringe Benefit Account Number (new NI account), and Fringe Benefit Chart of Accounts Code (NI); e-doc will be routed to the FA for approval.

It is important for FAs to ensure that all steps are completed prior to incurring payroll charges in the new General Fund accounts. If all steps are not completed, the new General Fund account operating chart will incur the fringe benefit charges. General Accounting will then need to work with the FA to reverse the fringe benefit charges from the operating chart and post to the NI chart.

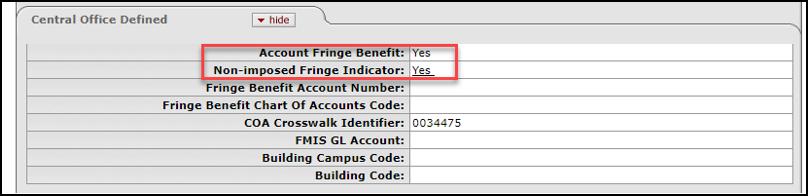

If the new General Fund account shows the following attributes, the account is not ready for use.

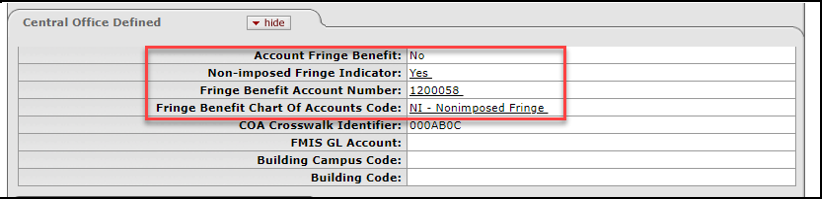

When the new General Fund account shows the following attributes, the account is ready for use.

(Fringe Benefit Account Number will be the same as the newly created General Fund Account number)

Should there be any questions, please email uhgalc@hawaii.edu.

___________________________________________________________________________________________________________________

Equipment – FY 2023 Annual Inventory Verification Report

Target Audience: Fiscal Administrators and Staff

The PDF files of the annual inventory verification reports have been posted to your FO folder in PageCenterX : KFS → CAM → CMT002-Annual_Inventory_Verification_Report.pdf.

- FAs should forward a copy of the annual report to each custodial department as well as the Annual Inventory Verification Report Instructions for performing the actual physical inventory verification in accordance with AP 8.540 – Physical Inventory. The custodial department should assign personnel other than the asset representative or principal investigator to conduct the physical inventory and certify the report.

- FAs should also forward a separate copy of the annual report to each asset representative (as applicable) for their information and review. As a reminder, asset representatives should not perform the physical inventory of property under their custody nor certify the report.

- Departments are reminded that property shall not be disposed, cannibalized, salvaged, or transferred until the appropriate KFS approvals have been obtained (ref. AP 8.543, Property and Equipment Transfer and Retirement).

- An Excel file of your equipment inventory is available upon request by sending an email to caao@hawaii.edu.

After completing the physical inventory, the scanned PDF copies of the certified reports (digital signature accepted) should be emailed to caao@hawaii.edu and are due to CAAO no later than Friday, October 13, 2023.

If there are any questions, please contact CAAO at caao@hawaii.edu.

___________________________________________________________________________________________________________________

Payment Request (PREQ) Reminders

Target Audience: Fiscal Administrators and Fiscal Support Staff

As we start the new fiscal year, here are a few reminders to help facilitate payments via PO:

- LABELING

- Label file name in proper format (PO #_Invoice #_first 3 letters of vendor)

- Identify Contract Payments in email subject line (PO #_ Contract #_Invoice #_first 3 letters of vendor)

- Identify Wire Transfer Payments in email subject line

- Invoices must be saved, labeled and submitted as separate files

- PURCHASE ORDERS

- PO is in OPEN status and has sufficient encumbrance

- Vendor name on PO and invoice must match

- Remit address is current on KFS vendor record

- DO NOT use the additional charge lines on the PO. Tax, freight, etc, should be line items in the process items section

- INVOICES

- We do not short pay invoices – the department should request for a revised invoice or provide an email from vendor authorizing short pay

- Invoices dated over one year require a late payment memo (from the department)

- Provide breakdown for POs with multiple item line #s

- Invoices and credit memos must be attached to the same email

- We cannot enter negative numbers on the PREQ. Discounts should be netted out from a line item

- Invoices labeled as “duplicate,” “copy” or “reprint” must be certified as original

- SSNs, credit card numbers, PPI, etc. must be redacted prior to submission

- DISBURSING FORMS

- Please ensure you are using the most current form(s) when submitting

- Non-Employee Invoice (NEI) form must have original signature or signature audit log attached

- DISB 37 Special Handle forms must be approved and signed by JR Kashiwamura, Director of Disbursing Office, prior to submission

Invoices that do not meet the above criteria, may be returned for correction and/or re-submission.

Any questions, please call the Disbursing Office at (808) 956-5535.

___________________________________________________________________________________________________________________

Disbursement Voucher (DV) Reminders

Target Audience: Fiscal Administrators and Fiscal Support Staff

The Disbursement Voucher (DV) is used to reimburse employees for expenses incurred while conducting University of Hawai’i business and pay recurring payments to vendors such as utility payments and scholarship payments. To make DV processing smoother and to ensure payments are processed on time, please label the DV Description as follows: 3-Digit FO Code followed by a short description.

Examples:

- 029 Mileage Lucas July 2023

- 070 Utilities HECO July 2023

- 055 Stipend Johnson Fall 2023

- 060 Reimburse DOE

- 014 Wire Transfer

Any questions, please call the Disbursing Office at (808) 956-5535.

___________________________________________________________________________________________________________________

New e-mail Notification for Changes Made to Employees’ Direct Deposit Accounts

Target Audience: Fiscal Administrators and Fiscal Support Staff

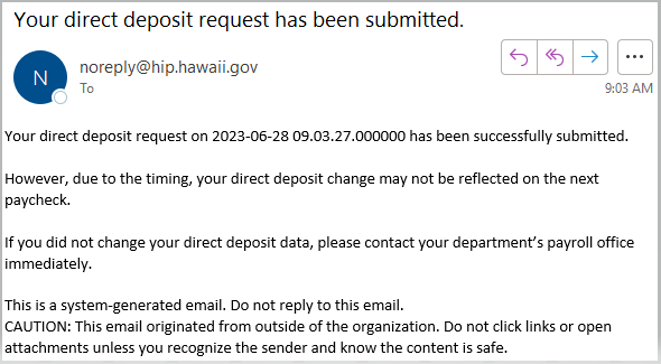

HIP recently introduced a new feature that will send an automated email to UH employees when payroll direct deposit information has been updated in their system. This notice is to not only confirm that direct deposit changes have been made, but to also alert employees who may have fraudulent direct deposit activity on their HIP account, in which changes have been made without their knowledge or consent.

If an employee receives this notice, and has not made changes to their payroll direct deposit, the employee should contact/email the UH Payroll Office immediately (payroll@hawaii.edu).

___________________________________________________________________________________________________________________

Payments as stipends, travel reimbursements, scholarships and tax facts

Target Audience: Fiscal Administrators and Fiscal Support Staff

Did you know?

- The word “stipend” is often misunderstood as “scholarship”. Stipend means payment and nothing more. The reasons and circumstances for such stipend will dictate whether stipend should be scholarship or taxable income.

- Payment for “M & IE” (meals and incidental expenses) should only be paid to employees or independent contractors. Very frequently, M & IE is calculated inappropriately for other people who are not employees or independent contractors.

- The University of Hawai’i does not pay general excise tax on its revenue. However, for purchases, UH generally pays general excise tax if seller (vendor) is licensed to do business in Hawai’i. You will need to ask seller (vendor) if they have general excise tax license. Otherwise, seller (vendor) may be overcharging you.

- Payments to students for doing tasks at UH should be considered as income to the student. Whereas, payments to students with no expectation of doing work in return, is generally a scholarship.

- When vendors ask UH for tax exempt certificate, they are asking for the document that would support UH being exempt from paying general excise tax. UH is not exempt from paying general excise tax on purchases when vendors have general excise license. Therefore, in most circumstances, UH does not qualify to seek tax exempt certificates. But you need to confirm with vendors to ensure that they have general excise tax license. Otherwise, you may be overcharged by vendors unnecessarily with general excise tax.

- When “travel costs” are reimbursed to students to attend conferences for Chartered Student Organization (CSO) events, costs relating to the conferences (lodging, airfare, transportation) would be a business expense of the University and not taxable income to the students attending these events. For example, UH Manoa CSO is comprised of the Campus Center Board, Graduate Student Organization, Student Activity and Program Fee Board, Student Media Board, and Associated Students of the University of Hawai’i.

Should you have any questions on this topic, please contact Kenneth Lum at kenlum@hawaii.edu.