The University of Hawaii offers a 457(b) plan, known as the “Island Savings Plan”.

The Plan is intended to help you save for retirement using pre-tax contributions, Roth 457 contributions, and potential tax–deferred growth.

The plan is currently administered by Empower. Participation in the 457(b) plan is completely voluntary.

Refer to FAQs on the program and to set a course for a more financially secured retirement.

(Note: Effective April 1, 2022, Empower officially acquired the full-service retirement business of Prudential. Contact information and forms remain the same for now. Please review the Empower Transition Disclosure for important information and more details associated with the acquisition.)

The Island Savings Plan (ISP) is available to employees eligible to participate in the State of Hawaiʻi Employees’ Retirement System (ERS).

Enrollment Form

Complete Enrollment and Beneficiary Form and mail to:

Empower

1100 Alakea St. Suite 1550

Honolulu, HI 96813

Enrollment Form Tips:

- Sub Plan Number is 000001 (State of Hawaii)

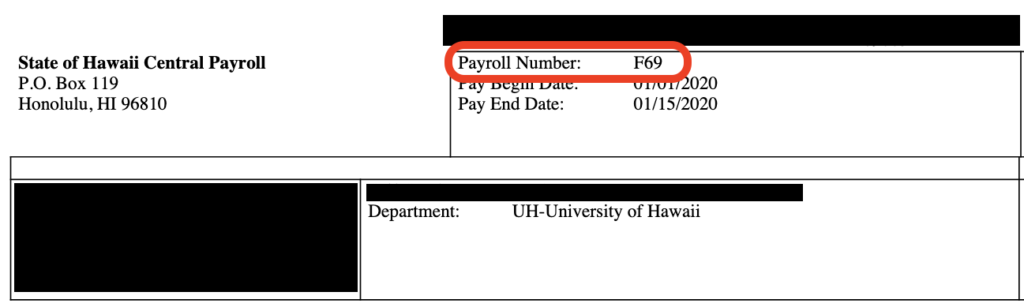

- Payroll Number

- Find your 3-digit payroll number located on the top portion of your paystub.

- Find your 3-digit payroll number located on the top portion of your paystub.

- Contribution amount

- Dollar amounts must be in whole dollars, minimum of $10 per pay period OR a percentage of pay between 1% to 99%.

Need assistance with completing the Form or not sure which investment option to choose?

- Schedule a one-on-one session with an Island Savings Plan local Retirement Education Counselor

- Review investment information provided by the Island Savings Plan

- Attend an Island Savings Plan Webinar or check out their Financial Wellness web page.

- Consult with your financial advisor

When will my deferral change take effect? See 2024 Deferral Change Schedule.

Rollover & Transfers

Other qualified retirement accounts may be consolidated into the Island Savings Plan by a Direct Rollover such as a section 401(k), 403(b), IRA, and 457(b) programs/plans. The Plan’s Rollover In form can be found by logging into your account and clicking on View Statements and Documents then look for the Plan Forms section found under the Plan Information heading on the left-hand side of the page. If you have not established an account, you can contact Empower’s local Honolulu office by dialing 888-71-ALOHA (888-712-5642) and selecting option “2” for help with accessing the Rollover In form.

You can elect to rollover your ERS contributions into the Island Savings Plan. Since the ERS funds are already taxed on a State level, a special ERS Rollover/Transfer In Form is required to retain the state exemption. This form can be obtained by logging into your account and clicking on View Statements and Documents then look for the Plan Forms section found under the Plan Information heading on the left-hand side of the page. Detailed instructions are on the form. If you have any questions or require any assistance, please contact an Empower Retirement Education Counselor at the local Honolulu office by calling 888-71-ALOHA (888-712-5642) and selecting option “2.”

Withdrawals

You may be able to take money from your account while an active employee in four ways:

- A qualified unforeseeable emergency as defined by the IRS

- Disaster Relief Withdrawal

- A qualified de minimis withdrawal

- Funds rolled into the plan may be withdrawn at any time

- All or some funds may be withdrawn once you reach age 70½

A Hardship Withdrawal Request form can be found by logging into your account and clicking on View Statements and Documents then look for the Plan Forms section found under the Plan Information heading on the left-hand side of the page. For assistance, you can contact Empower’s local Honolulu office by dialing 888-71-ALOHA (888-712-5642) and selecting option “2” and schedule an appointment with an Empower Retirement Education Counselor.

You may contribute up to 99% of your monthly gross compensation before taxes (minimum $10 per pay period) up to the annual IRS limit. If you are at least age 50 or are within three years of the plan’s “normal” retirement age, you may be able to save more with “catch-up” contributions.

2024 Contribution Limits

- Employees under the age of 50 – The annual base deferral limit is $23,000;

- Employees age 50 and higher – The Age 50 catch-up limit is $30,500 ($23,000 + $7,500).

Special 3-year catch-up

If you have not always contributed as much as allowed each year, starting three years before your “normal” retirement age you may be able to save up to twice the annual limit, or $46,000 in 2024, to make up for earlier years when you did not contribute the maximum. You may not use both the Age 50+ Catch-Up and Special 3-Year Catch-Up in the same year.

Remember:

- UH employees may choose to participate in both the 403(b) TDA program and the 457(b) Deferred Compensation Plan.

- Each plan has a separate annual contribution limit; therefore, an employee may defer up to the maximum amount in each plan (e.g., in 2024, employees under the age of 50 may contribute $23,000 in the 403(b) plan and $23,000 in the 457(b) plan / employees age 50 and higher may contribute $30,500 in the 403(b) plan and $30,500 in the 457(b) plan).

Administration Fees

There are general Plan administrative fees that the employee pays. This fee amount is 7.5 basis points, which is .075% of your account balance, and is paid to Empower. This annualized fee is deducted from your account on a quarterly basis.

Investment Fees

Each investment option charges an investment management fee, which is deducted from the investment option’s return. Please see the Investment Information section each investment option’s fees, or you may call the Plan’s toll-free Information Line at (888) 712-5642.

Virtual Workshops

Island Savings Plan offers workshops once every quarter for the University of Hawaiʻi. Check the OHR Training & Informational Sessions calendar for upcoming workshops. They also hold weekly webinars for State Employees.

Have questions or want personalized planning guidance?

Island Savings Plan Retirement Education Counselors are available to help you:

- Review your account and set financial goals

- Make updates to your savings and/or adjust your asset allocation to help you reach your goals

- Enroll in the plan

- Learn how the Plan’s tools and resources can help you improve your financial wellness, even if you are experiencing day-to-day struggles

Schedule an Appointment:

- Visit Retirement Counselors for a list of Empower Retirement Education Counselors and click on the “Schedule an appointment” link.

- Or call 888-712-5642 and select option “2” to set up a phone or virtual appointment.

Create your online account

If you’re already in the plan, set up your account online to set your contribution rate, and review or update your investments as well as your beneficiaries. You can also start taking advantage of a wealth of tools and resources from Empower.

If you will be receiving a retroactive paycheck or large payout, you may elect to have a one-time increase to the Island $avings Plan. You must contact the Empower’s Honolulu Office at 1-888-712-5642 (option 2) to discuss this option and to assist with completion of One-Time Lump Sum Pay Contribution Election Form. (Note: Parts of the form is currently being updated from Prudential to Empower. The phone and fax numbers on the form remain the same.)