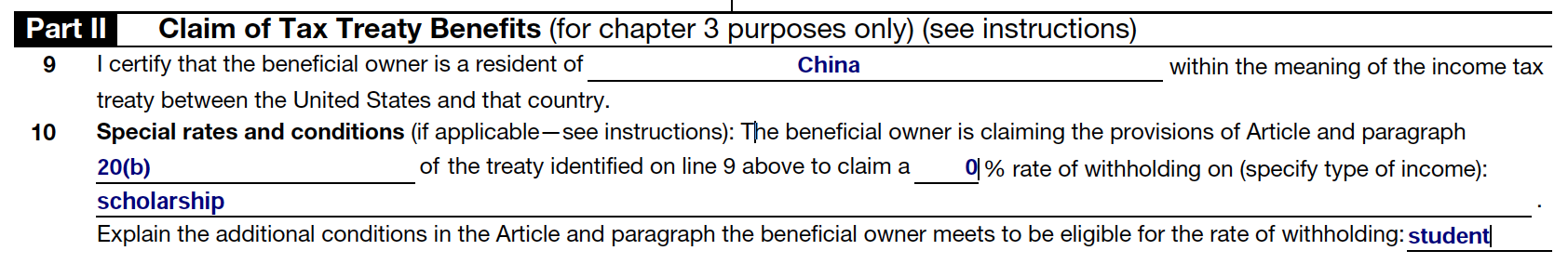

If you are (1) on a student visa and (2) receiving a scholarship overaward from the University of Hawai'i, then look at the table below to see if you are eligible for a tax treaty benefit on that amount. Tax treaty benefits on scholarships mean that you do not pay taxes on that scholarship. Use the information from the table to complete Part II on the form W-8BEN. See the following sample:

If your country is listed, understand the following information:

- Country: This is the country that has the tax treaty with the U.S. If your permanent residence is in that country, you may qualify for the tax treaty benefit even if your country of citizenship is different.

- Maximum Presence in the U.S.: This is the amount of U.S. presence (in calendar years) in which you may receive this benefit while you are on a student visa.

- Maximum Amount of Compensation: This is how much you may receive. It could be unlimited, or limited. If the latter, read the details of the limits in the tax treaty.

- Treaty Article Citation: This is the article and paragraph number within the treaty that identifies your scholarship benefit.

NOTE: In all treaties listed below except for the Commonwealth of Independent States (Armenia, Azerbaijan, Belarus, Georgia, Kyrgystan, Moldova, Tajikistan, Turkmenistan, and Uzbekistan), the payment must be from a nonprofit organization (e.g., University of Hawai'i). In many cases, the exemption also applies to amounts from either the U.S. or foreign government. For Indonesia and the Netherlands, the exemption also applies if the amount is awarded under a technical assistance program entered into by the United States or the foreign government, or its political subdivisions or local authorities.

This information relates only to scholarship, fellowships or grants paid to full-time students by a U.S. source. Use the search to find your country. Updated for 2023| Country | Maxmimum Presence in the U.S. | Maximum Amount of Compensation | Treaty Article Citation |

|---|---|---|---|

| Armenia(1) | 5 years | Limited(2) | VI(1) |

| Azerbaijan(1) | 5 years | Limited(2) | VI(1) |

| Bangladesh | No specific limit | No limit | 21(2) |

| Belarus(1) | 5 years | Limited(2) | VI(1) |

| China, People's Rep. of | No specific limit | No limit | 20(b) |

| Cyprus | Generally, 5 years | No limit | 21(1) |

| Czech Republic | 5 years | No limit | 21(1) |

| Egypt | Generally, 5 years | No limit | 23(1) |

| Estonia | 5 years | No limit | 20(1) |

| France | 5 years | No limit | 21(1) |

| Georgia(1) | 5 years | Limited(2) | VI(1) |

| Germany | No limit | No limit | 20(3) |

| Iceland | 5 years | No limit | 19(1) |

| Indonesia | 5 years | No limit | 19(1) |

| Israel | 5 years | No limit | 24(1) |

| Kazakhstan | 5 years | No limit | 19 |

| Korea South | 5 years | No limit | 21(1) |

| Kyrgystan(1) | 5 years | Limited(2) | VI(1) |

| Latvia | 5 years | No limit | 20(1) |

| Lithuania | 5 years | No limit | 20(1) |

| Moldova(1) | 5 years | Limited(2) | VI(1) |

| Morocco | 5 years | No limit | 18 |

| Netherlands | 3 years | No limit | 22(2) |

| Norway | 5 years | No limit | 16(1) |

| Philippines | 5 years | No limit | 22(1) |

| Poland | 5 years | No limit | 18(1) |

| Portugal | 5 years | No limit | 23(1) |

| Romania | 5 years | No limit | 20(1) |

| Russia | 5 years | No limit | 18 |

| Slovak Republic | 5 years | No limit | 21(1) |

| Slovenia | 5 years | No limit | 20(1) |

| Spain | 5 years | No limit | 22(1) |

| Tajikistan(1) | 5 years | Limited(2) | VI(1) |

| Thailand | 5 years | No limit | 22(1) |

| Trinidad and Tobago | 5 years | No limit | 19(1) |

| Tunisia | 5 years | No limit | 20 |

| Turkmenistan(1) | 5 years | Limited(2) | VI(1) |

| Ukraine | 5 years | No limit | 20 |

| Uzbekistan(1) | 5 years | Limited(2) | VI(1) |

| Venezuela | 5 years | No limit | 21(1) |

(1) This country is part of a group of countries known as the "Commonwealth of Independent States," whose tax treaty dates back to the U.S.-U.S.S.R. Income Tax Treaty, signed June 20, 1973.

(2) Generally, limited to $10,000 annually to provide ordinary living expenses.